The Buzz on Amur Capital Management Corporation

A business's capability to increase dividends regularly can show protability. Firms that have excess cash money ow and strong nancial placements usually pick to pay rewards to attract and compensate their investors.

Little Known Facts About Amur Capital Management Corporation.

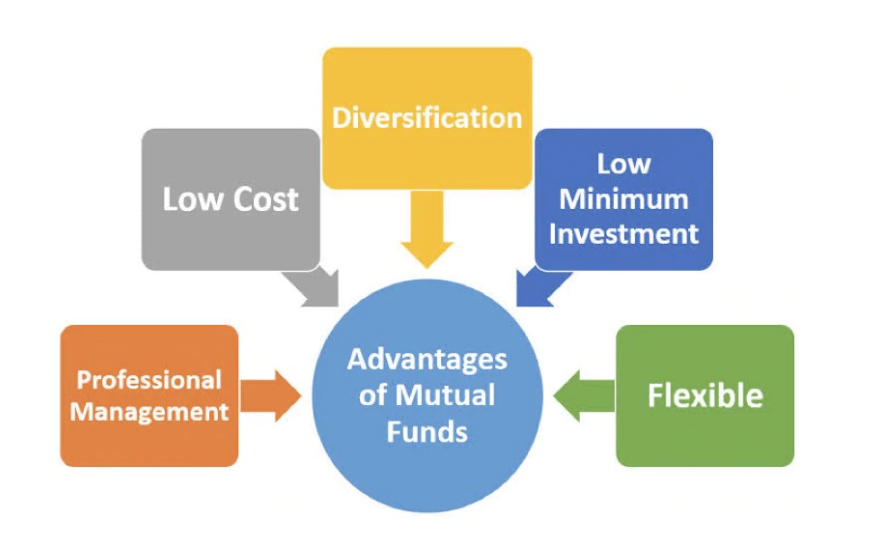

We have actually located these supplies are most in danger of reducing their rewards. Diversifying your investment portfolio can aid safeguard against market uctuation. Look at the following aspects as you intend to branch out: Your profile's property class mix is just one of one of the most important elements in establishing efficiency. Consider the size of a firm (or its market capitalization) and its geographical market U.S., established worldwide or emerging market.

Regardless of how very easy digital financial investment management systems have actually made investing, it shouldn't be something you do on an impulse. Actually, if you determine to go into the investing world, one point to think about is how much time you actually intend to spend for, and whether you're prepared to be in it for the long run.

As a matter of fact, there's a phrase common connected with investing which goes something along the lines of: 'the round may drop, but you'll want to make sure you're there for the bounce'. Market volatility, when economic markets are going up and down, is a typical sensation, and long-lasting could be something to aid ravel market bumps.

Excitement About Amur Capital Management Corporation

Joe invests 10,000 and makes 5% reward on this investment. In year two, Joe makes a return of 525, due to the fact that he said not only has he made a return on his initial 10,000, however also on the 500 spent returns he has actually gained in the previous year.

Some Ideas on Amur Capital Management Corporation You Need To Know

One method you might do this is by getting a Supplies and Shares ISA. With a Supplies and Shares ISA. passive income, you can invest approximately 20,000 each year in 2024/25 (though this goes through change in future years), and you don't pay tax on any kind of returns you make

Getting going with an ISA is truly simple. With robo-investing systems, like Wealthify, the hard work is provided for you and all you require to do is choose just how much to spend and choose the threat level that suits you. It may be one of the couple of instances in life where a much less emotional strategy might be advantageous, however when it concerns your funds, you may wish to pay attention to you head and not your heart.

Staying focussed on your long-term goals might assist you to stay clear of unreasonable choices based on your emotions at the time of a market dip. The tax treatment depends on your private scenarios and might be subject to alter in the future.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Investing goes one action even more, aiding you accomplish individual goals with 3 considerable advantages. While saving ways reserving component of today's cash for tomorrow, investing methods putting your money to function to potentially make a much better return over the longer term - best investments in canada. https://www.avitop.com/cs/members/amurcapitalmc.aspx. Various classes of financial investment assets cash, dealt with rate of interest, residential property and shares usually generate various levels of return (which is family member to the threat of the investment)

As you can see 'Development' properties, such as shares and residential property, have actually historically had the most effective overall returns of all property classes yet have likewise had larger optimals and troughs. As an investor, there is the prospective to gain resources growth over the longer term in addition to a recurring income return (like returns from shares or lease from a residential property).

Facts About Amur Capital Management Corporation Revealed

Inflation is the ongoing rise in the cost of living over time, and it can influence on our financial wellbeing. One way to help surpass inflation - and generate favorable 'actual' returns over the longer term - is by spending in possessions that are not simply efficient in supplying higher income returns but also supply the possibility for funding growth.

There are several kinds of offshoring: Company, spending, and banking. This is the act of establishing specific business features, such as manufacturing or phone call facilities, in a nation other than where the firm is headquartered.

There are several kinds of offshoring: Company, spending, and banking. This is the act of establishing specific business features, such as manufacturing or phone call facilities, in a nation other than where the firm is headquartered. Holding accounts overseas topics you to more analysis. That's due to the fact that it's commonly seen as a means for individuals to stay clear of paying tax obligations. If you don't report your holdings to your tax authority, such as the Internal Income Solution (IRS), you could be in significant problem. As discussed above, also though some jurisdictions give full confidentiality to account holders, an increasing number of nations are becoming much more clear with tax authorities.

Holding accounts overseas topics you to more analysis. That's due to the fact that it's commonly seen as a means for individuals to stay clear of paying tax obligations. If you don't report your holdings to your tax authority, such as the Internal Income Solution (IRS), you could be in significant problem. As discussed above, also though some jurisdictions give full confidentiality to account holders, an increasing number of nations are becoming much more clear with tax authorities.

Upgraded (return to) properly signedor. All monetary organizations are called for to recognize and recognize the origin of any kind of funds that are transferred into the account. It will be required that you supply satisfying proof of the resource of your wide range. This may consist of a bank statement, payslips and also financial investment declarations.

Upgraded (return to) properly signedor. All monetary organizations are called for to recognize and recognize the origin of any kind of funds that are transferred into the account. It will be required that you supply satisfying proof of the resource of your wide range. This may consist of a bank statement, payslips and also financial investment declarations. : Sending out a wire transfer is a basic operation, but nearly all banks bill global wire transfer fees to send out or receive funds. High worldwide deal costs can accumulate rapidly, which can straight influence earnings margins - offshore company formation. Be sure to look out for deals as rates for wire transfers varies in between banks.

: Sending out a wire transfer is a basic operation, but nearly all banks bill global wire transfer fees to send out or receive funds. High worldwide deal costs can accumulate rapidly, which can straight influence earnings margins - offshore company formation. Be sure to look out for deals as rates for wire transfers varies in between banks. In some countries, banks allow offshore clients to establish accounts with lower balances than what you spend for your regular monthly home mortgage and even a pair of weeks of grocery stores. Bear in mind that while you can open up accounts with moderate starting equilibriums, it might be a long time prior to those balances begin to generate any rate of interest.

In some countries, banks allow offshore clients to establish accounts with lower balances than what you spend for your regular monthly home mortgage and even a pair of weeks of grocery stores. Bear in mind that while you can open up accounts with moderate starting equilibriums, it might be a long time prior to those balances begin to generate any rate of interest.